NFT boomed in 2021, growing to about $22 billion and attracting about 280,000 buyers, sellers, and about 185,000 unique wallets. Unfortunately, as the market grew, so did the opportunities for cybercrime, with attractive reports of NFT scams, NFT art scams, and NFT game scams. Spend enough time online, and you’re bound to run into scammers who will try to steal your money by asking you to verify your credit card information or sign up for fake PC security plans. Read on to learn more about NFT meaning and how to avoid NFT scams.

What is the NFT?

An NFT, or non-fungible token, is a class of digital assets minted on a blockchain. Each token is unique and considered a separate item in all but physical capacity. Meta has its own beginner’s guide to NFT and uses the Mona Lisa example to describe NFT. However, just as there is only one Mona Lisa in the world, there can also only be one instance of NFT, even digitally.

Examples of NFT images

In essence, NFTs are digital assets – this is where the “token” part of the non-interchangeable token comes into play. When you buy an NFT attached to a digital asset, you do not own the asset itself. Therefore, you cannot reproduce it or use it for commercial purposes. Instead, you become the owner of a record of the purchase on the blockchain, which you can keep or sell to someone else. Because NFTs are created from digital objects that represent both tangible and intangible objects, they can be:

- Art

- Collectibles

- Music

- Video

- Gifs and memes

- Virtual Avatars.

This list is incomplete; people buy NFTs as unique investments and collectibles. NFTs can be sold for millions of dollars.

just setting up my twttr

— jack (@jack) March 21, 2006

Thus, Jack Dorsey, CEO of Twitter and Square, sold his first tweet as an NFT for more than $2.9 million.

How is an NFT created?

NFTs are created using a “minting” process. This process aims to make it one-of-a-kind without the possibility of reproduction, which is achieved by a unique signature. Consequently, if someone were to take a screenshot of an NFT picture, it would not be authentic because it lacks a unique signature. Once created, the NFT is saved in a blockchain. From there, the creators or owners of each NFT can sell, buy or exchange these unique tokens through trading floors using one form of cryptocurrency.

How do NFTs work?

NFT is the digital equivalent of collectibles. Instead of a work of art, the buyer receives a digital file. This gives him exclusive ownership since an NFT can have one owner at a time. The request is confirmed by the unique data associated with each NFT. The owners or creators may also store certain information in them – for example. In addition, articles may include their signature in the NFT’s metadata.

So, when you want to collect NFTs, you need a wallet to store cryptocurrency, NFTs, and cryptocurrency to make NFT purchases. In addition, there are unique NFT marketplaces where you can browse NFT – some of the best-known include OpenSea, Raible, and Foundation. Many argue that NFT is a way to support digital artists. In contrast, others say that any transaction in blockchain involves a resource cost. If you are interested in NFT, you should know the risks involved, including NFT fraud and scams.

Types of NFT scams

Like other cryptocurrencies, NFT is a mostly unregulated space. Consequently, criminals can exploit loopholes and carry out fraud. That’s why NFT Ponzi schemes, OpenSea scams, and NFT art funding scams have been in the news. Here are some of the most notorious NFT scams:

Impersonation

Some third-party marketplaces, such as OpenSea, are designed to facilitate NFT transactions and provide the security that is the foundation of every sale. However, criminals can create fake marketplaces with similar URLs. Because an NFT image or some visual information (such as open text) can easily be copied, these websites may look identical to legitimate marketplaces. However, the true purpose of these sites is to deceive users.

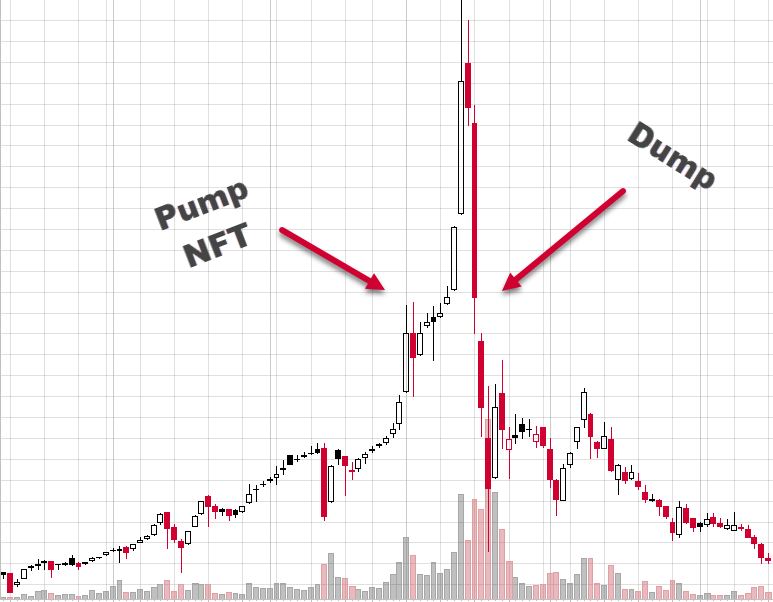

Rugpulls

A rugpull, also known as pump-n-dump, is a scam when promoters of a scheme intentionally advertise it through social media to increase the price. But as soon as they take investors’ money, the advertising stops, and crooks pull out their stake (which is often exceeds 80% of the market cap). That causes the asset’s value drop, and investors lose money. Another variation of this theme is when NFT developers remove the ability to sell the token by adding code that prevents the sale. As a result, the buyer is left with an unsellable asset, and fraudsters are free to withdraw their money at any moment.

Scammers artificially raise the price.

Phishing scams

To buy NFT, you need to register a crypto wallet. NFT phishing scams usually target customers with fake ads. For example, on Discord, Telegram, and other public forums, they may ask for your private wallet keys and a 12-word security phrase. Scammers can also impersonate MetaMask and send users fake emails warning them that their wallets will be blocked due to security issues. The scammers then offer to click a link that the email contains to confirm the account. Such an NFT scam aims to obtain personal information and empty the victim’s digital wallet.

Customer support scams

This attack is similar to the previous one. However, here the hackers pretend to be technical support or customer support employees for blockchain trading sites and often contact potential victims via Telegram or Discord. They may send out links that lead to fake sites, hoping to get personal information and access to cryptocurrency wallets. Sometimes they ask the victim to share their screen to solve the problem. They aim to see and take a screenshot of your cryptocurrency wallet credentials.

Bidding scams

Bidding fraud occurs when investors want to resell on the secondary market the NFTs they purchased. Bidders may change your preferred currency to cryptocurrencies with a lower value and fail to inform you after you list your NFT sales. Please double-check the money before agreeing to the deal to avoid a potential loss for the seller.

Counterfeit NFTs

Fraudsters can steal or copy artwork and then post fake content on legitimate sites like OpenSea. As a result, unsuspecting buyers may buy a fake NFT with no value.

These NFTs were sold as 3D pictures. But it turned out that they were simple emoticons.

NFT giveaway and NFT airdrop scams

Sometimes scammers can impersonate legal NFT trading platforms on social media and advertise NFT giveaways. They usually offer a free NFT per repost of their post or if you sign up through their website. Once you sign up, you will be asked to link your wallet credentials to get your “prize.” However, this way, they can access your account and steal the contents of your wallet.

Investment scams

Since cryptocurrency transactions are anonymous, investment fraud is a common phenomenon for NFTs. Taking advantage of anonymity, scammers create projects with seemingly viable investments and then disappear without a trace with the funds they collected from potential clients.

Examples of NFT scams

Evolved Apes

In 2021, a collection of 10,000 “evolved monkeys” entered the market. The challenge for buyers was to get a unique monkey made up of composite elements. These elements could be battled with other monkeys in a slugfest fighting game, where prizes were rewarded in cryptocurrency. NFT’s original proposal was to raise funds for the game. However, once the developer, known as “Evil Monkey,” raised 798 ether (about $2.7 million at the time), he disappeared. Instead, investors received jpeg images to show as their investment.

Fractal

Fractal is a trading platform for NTF game items. Unfortunately, in 2021, scammers created a fraudulent NFT giveaway that caused victims to lose more than $150,000 in cryptocurrency. Buyers had hoped to receive a limited edition NFT. However, they were surprised to discover that the link sent through the project’s official Discord channel was fraudulent. Those who followed the link and connected their cryptocurrency wallets hoping to get NFTs lost their cryptocurrency assets as they were transferred to the fraudsters’ accounts.

Frosties

The Frosties NFT scam was another example of a rug pull scam that resulted in the theft of at least $1.2 million. The creators of an NFT collection called Frosties absconded with investor funds, deactivating all communication channels with participants and leaving a community of about 40,000 people who were promised various rewards.

How to avoid NFT scams

So, now that we’ve looked at some of the most common NFT scams, we’ll look at how to avoid them. Our tips may not seem as far off as you see for online transactions and email phishing scams, but doing a few things to keep your information safe can make a big difference.

Do the research

You should check the details of any transaction before agreeing to it. Regardless of whether the marketplace is reputable and well-known, review the buyer or seller’s transaction history. Also, read reviews and look at the level of engagement of the creators to see if there have been any previous complaints about their transactions. Finally, if you’re investing in a project, check out the developers behind it to ensure they’re genuine.

Do not open files and links

Only open files from senders you know well. Hackers have created viruses that target cryptocurrency wallets, so-called cryptostealers. Links can also lead to fraudulent exchange sites. Never click on links or attachments from unknown sources.

Be suspicious of giveaways

Although common in the NFT space, giving “gifts” can often carry security risks. Because every NFT is tied to a contract, that contract determines what you can do with it. Hackers can attach authorizations to access your wallet, sell your assets, and more. Never accept an NFT from someone you don’t know or trust.

Keep the private key or sid-phrase of your cryptocurrency wallet secret.

Never share your private key and source phrase with anyone. If someone has this data, they can access your wallet and remove any NFT or cryptocurrency without a trace. Therefore, using strong passwords and two-factor authentication for all your NFT accounts is critical.

Double check the NFT price

Before buying an NFT, check the price on official trading platforms like OpenSea or others. If the price is lower than what is listed on a legitimate trading site, proceed cautiously – it could be a scam.

Use burner wallets

Using a burnable wallet will limit your spending on a particular purchase – including cryptocurrency, to pay for transactions. This reduces the risk in case of fraud.

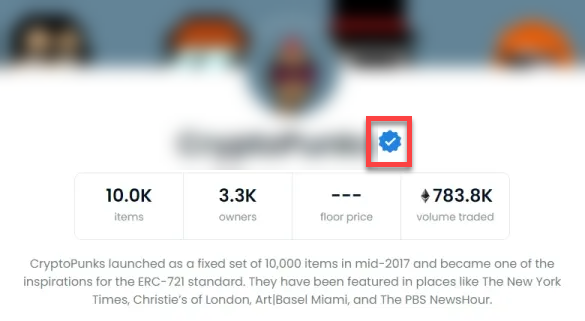

Check verification marks

Most legitimate NFT sellers have a blue checkmark beside their usernames on OpenSea and other NFT marketplaces, and collection properties will be listed. Make sure the performer you buy has a verified account and is legitimate. Look for the performer on social media or their website. You can ask them if the work you want to buy belongs to them and if you have the correct user profile.

That’s blue check mark next to the username

NFT is an unusual invention, but it is still a relatively new technology. Like any new invention, it is subject to constant change and improvement and is vulnerable to breaches and exploits. Many new developments in this area aim to make it easier to invest in NFT and limit losses in case of security breaches. As these improvements are still in development, NFT investors must play their part in protecting themselves from rogue players trying to get other people’s investments by any means necessary.