Nowadays, with the Internet in almost every part of the world, it is unrealistic to hide anything. Consequently, if something happens, only lazy people do not know about it. So we see that the incident with the bankrupt Silicon Valley Bank is discussed by depositors, who were left without money, and by ordinary people who have nothing to do with SVB. However, some are particularly interested in this incident from the point of view of profit – these are crooks.

What happened to SVB?

Friday, March 10, 2023, will go down in banking history as a turning point. On this day that Silicon Valley Bank collapsed. It was the most significant event since the bankruptcy of Lehman Brothers in 2008. After customers withdrew more than $40 billion in just a couple of days, the bank went bankrupt. This turn of events baffled everyone. Both experienced analysts and ordinary people and startup founders. But, of course, the scammers didn’t leave this incident unattended, and several reasons exist. First, many companies don’t know how to pay emergency bills. Second, individuals who work for companies are worried about whether there will be problems with their paychecks. Third, depositors are wondering how to contact SVB now and what website to use. Finally, because it involves much money, it bodes well for fraudsters as a potential opportunity to make good money.

Who will be affected in the first place?

Some analysts are counting on the fact that, first of all, two categories will be affected: people working at Silicon Valley Bank and regional banks closely connected to SVB. Since employee information can be found in the public domain if you want it, it is highly probable that employees will face targeted attacks from fraudsters. These attacks could be phishing emails, phones, or SMS. The attack scenario will be approximately the same: pseudo-experts will offer loans, banking or legal services to victims. Also, a row of regional banks that were tied by their operations and finanses to SVB are also in risk. We are talking about the following banks:

- First Republic Bank

- Signature Bank

- Western Alliance Bancorporation

- Metropolitan Bank Holding

The attack scenario is quite simple: fraudsters email users, saying, “Because of the current circumstances, we recommend you protect your savings. You need to click on the link and enter your data.” So, on top of everything else, users risk losing access to their accounts. In addition, some law firms are creating unique pages to attract clients for possible litigation.

Registration of domains related to SVB

New domains containing SVB are already being registered. Not necessarily all of them are fraudulent. Competent firms may be able to help those who are affected. However, the fact of fraud should not be excluded. Below are a few domains containing SVB:

- login-svb.com (parked)

- svbclaim.com

- svbcertificates.com

- svbdeposits.com

- svblawsuit.com

- svbhelp.com

- svbbailout.com

- svbcollapse.com

Unfortunately, not all of these links will be safe. Some of them are registered by scammers to use later in spam mailings.

Email spam and social networks phishing

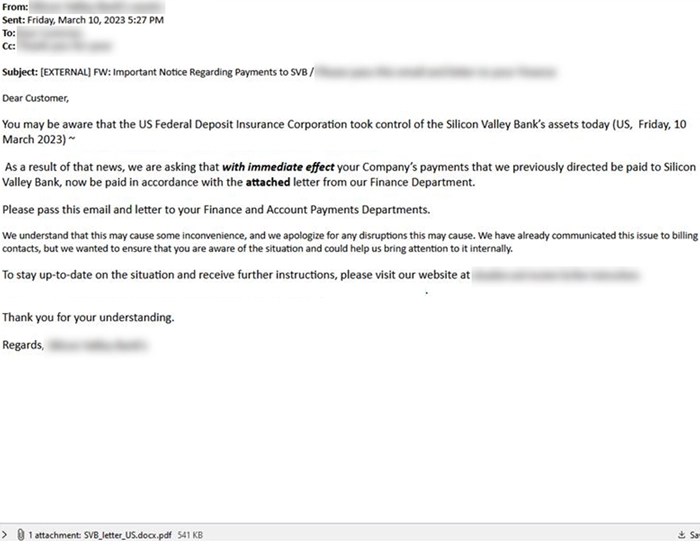

Spam mailings related to bankruptcy can contain offers of compensation. This is very effective because users lose their vigilance at such moments, are willing to click on the link without thinking twice, and hand over confidential information to scammers. However, as mentioned above, the link is almost always fraudulent, even if it looks natural. We recommend that you be careful with such emails and pay attention to the sender’s address, grammatical mistakes, and writing style. Official organizations know the name of each of their clients. Consequently, they always use a first-name address when contacting them, whether by email, text message, or phone call. If an email contains a “Dear Customer” style address, that is a red flag that the email is fraudulent.

An example of a phishing email

In addition to email, scammers may contact a potential victim through social media. For example, they will use LinkedIn, Facebook, or Twitter to contact bank customers and offer to help them save their money in case of bankruptcy. To do this, scammers create fake profiles with bank logos. However, bank employees are unlikely to search for a customer on social networks and ask for personal information.

Vishing

Vishing is a scam that takes place over the phone. Attackers are likely to introduce themselves as bank employees. They claim that they need your information to “save” it from being lost due to bankruptcy. They may also trick you into sharing personal information, such as Social Security numbers or passport numbers, claiming it is necessary to verify your identity and protect the victim’s funds. It is important to remember that no bank will ever ask for personal information or passwords over the phone or email. Do not reveal personal data if you receive a suspicious call or message. Instead, immediately contact the bank and ensure it was an actual request.